EPF announces that the minimum Employers share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the Employees share of contribution rate will be zero per cent. Thus EPF members including retirees may continue to contribute until the age of 75 years old.

Basics And Contribution Rate Of Epf Eps Edli Calculation

After attaining 58 years of age EPS Contribution By Employer 833 will add to EPF Contribution By Employer.

. When EPF was introduced people used to withdraw their EPF amount when they leave or quit their job. The minimum employers share of contribution rate has been set at 4 per month while the employees share of contribution rate will be 0. 28th June 2012 From India Chennai.

Dated 25 April fm m er notification a Member can deter the pension up to 60 years without contribution Member may defer the pension up to 59 years or 60 years of age without contributionBenefit of increase in original pension amount of 4 in case of one completed year and 816 in case of 2 completed years. Sun Mar 24 2019. Meanwhile the employees contribution rate for EPF.

That mean even in such conditions employer has to contribute same 12. This will reduce the deficit in the pension fund to Rs12-28 crores. Age 60 Years Investment Application can be made anytime.

The government is working on EPF premature withdrawal cap. In this scenario quantum of pension is increase by 4 per year beyond 58 years. Application through i-Akaun Member.

Yes the member has option to delay the pension beyond 58 years. The new minimum statutory rates. Get 60 years old to get 100 EPF corpus.

However employee is allowed to contribute voluntarily to his PF account if he continues in service after retirement. The Employees Provident Fund EPF today announced that employers will from now make a minimum statutory contribution of four per cent for employees above 60 years old against the present practice of contributing 60 and 65 per cent. The total projected deficit target of Rs27 067 crore can be reduced significantly by increasing the age limit to 60 years.

440E f Il w. 60 years in private sector. Bernama Epf Reduces Minimum Contribution For Employees Above Age 60 To 4 Per Cent - Lets break down the rules.

EPF chief executive officer Datuk Shahril Ridza Ridzuan was quoted as saying that the funds can only be withdrawn when members reach age 60 to ensure that they have sufficient retirement savings upon reaching that age. Upon 60 years of age a members savings in both the accounts will be consolidated for withdrawal purposes. If an employee completes his or her 60 years then he or she cant be on payrollmeans there would not be any deduction like PF ESIThey can be work in the company on contract basis only for the contractual employeesthere is no any deduction like PF ESI.

The Maximum age to contribute to EPF is 75 years old. October 14 2021 Post a Comment Each type of qualified retirement plan has different rules regarding how much if any you can still contribute to the account as you get older. 28th June 2012 From India Jaipur.

According to the EPFO raising the age limit will cut the pension funds deficit by Rs 30000 crore and will increase benefits to members since they would have two additional years of service. Epf Contribution After 60 Years Of Age. EPF members may receive dividends and retain savings until 100 years old.

Effective from 2019 the minimum employers contribution rate of EPF for employees aged 60 and above has been reduced to 4 per month. Previous employers EPF contribution rate was 6 per month for employees aged 60 and above while employees were required to contribute 55. 1 Member can opt for receiving pension after attaining 59 or 60 years of age but pension contribution stops after 58 years.

The 12 contribution made by the employer is split in the below-mentioned ways. EPF reduces minimum contribution for employees above age 60 to 4 per cent. Employees aged 60 years and above up to 75 years.

Cumulative contribution rate for those aged between 60-75 years is half 50 of the statutory contribution rates for both employees and employers stipulated above. New Minimum Statutory Rate For Employees Above Age 60 Takes Effect. Required to retain minimum amount of RM100000 in EPF account.

Subject to the salary. Do take note that any contributions to EPF after age 55 starting 1 January 2017 will be parked under a separate account Akaun Emas. The employer and employee contribute 12 of the employees basic salary and DA towards the EPF scheme.

Gazette 2016 Notification GSR. Employees share contribution on the other hand will now be. But that scenario changed when PF transfer through UAN and TDS on EPF withdrawal was introduced.

The Employees Provident Fund Organisation EPFO may soon give members an option to start drawing their pension once they turn 60 instead of 58 currently. The committee has also proposed to increase the Short Service Pension SSP entitlement age from 50 years to 55 years. Apart from the above-mentioned contributions the Government of India contributes 116 as well.

Transfer of withdrawal amount from Akaun EmasAkaun 55 is only allowed to the appointed FMIs. Employer is not required to contribute to PF after the retirement age ie.

Ren Ecosystem Extension Of Epf Contribution Rate Period For Employees

What Is Epf Deduction Percentage Quora

Lost Your Job Or Planning To Quit Here S How You Can Benefit From Your Epf

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Calculator Calculate Emi For Employees Provident Fund The Economic Times Richard Feynman Freeman Dyson Months In A Year

Steps To Maintain Current Employee Statutory Contribution Rate Asq

How Does A Lower Epf Contribution Impact Your Retirement Savings Tomorrowmakers

Switching Jobs Don T Forget To Check Your Eps Service History

Epf Contribution For Employee Age Above 60 Blog

Epfo Government Of India Will Pay The Epf Contribution Facebook

Epf Calculator Employees Provident Fund

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

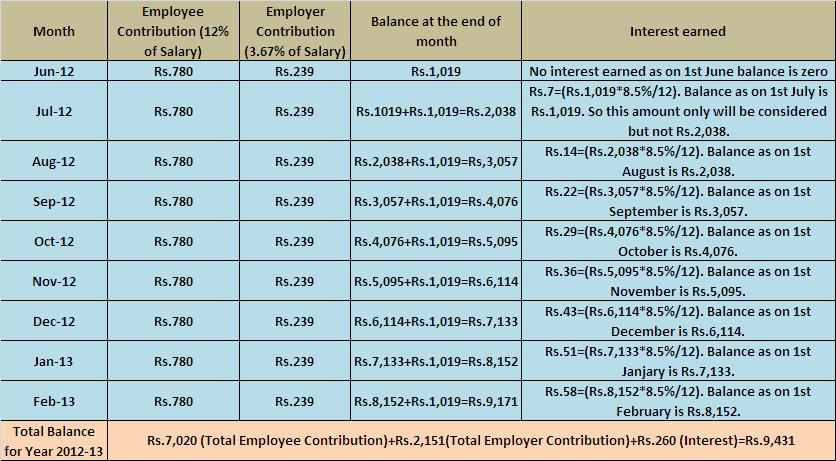

How Epf Employees Provident Fund Interest Is Calculated

Epf Contribution Rates 1952 2009 Download Table

Eps Vs Nps Vs Apy Comparison How To Find Out Retirement Planning Retirement Benefits

With Stock Markets Going Highly Volatile Equity Market Movements Are Not Making Sense Debt Funds Are Facing Def Safe Investments Investing Financial Literacy

India What S In A Comprehensive Employee Benefits Package

Employee Provident Fund A Complete Guide